Hard Money,

Easy Process.

At Crowd Lending, we understand every borrower is different, that’s why our platform offers flexible loan options tailored to you.

Hard money lending doesn’t need to be complicated. Whether you’re flipping your first property or managing a portfolio of multifamily projects, we move fast and keep things real.

Our creative and flexible lending options allow more choices for borrowers, allowing you to analyze multiple deals simultaneously.

the need for speedCrowd Lending, Inc. understands the need for speed in the hard money lending space.

Our common-sense approach and quick decision-making process give borrowers confidence that their next project will be funded.

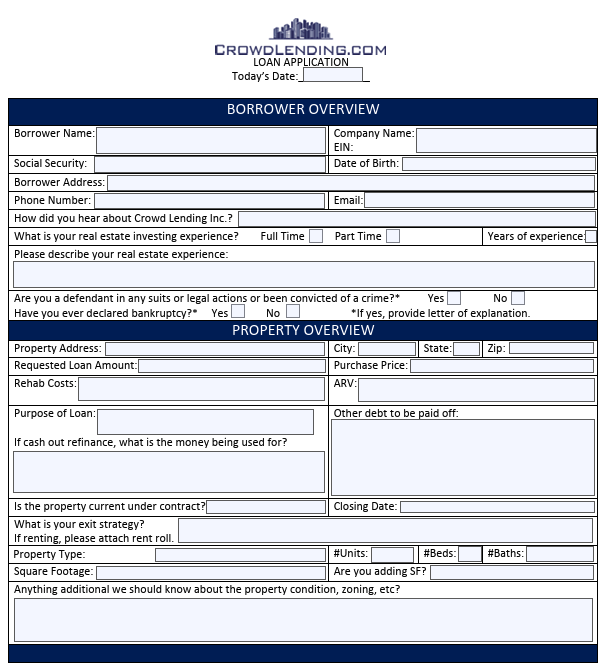

Our Process-

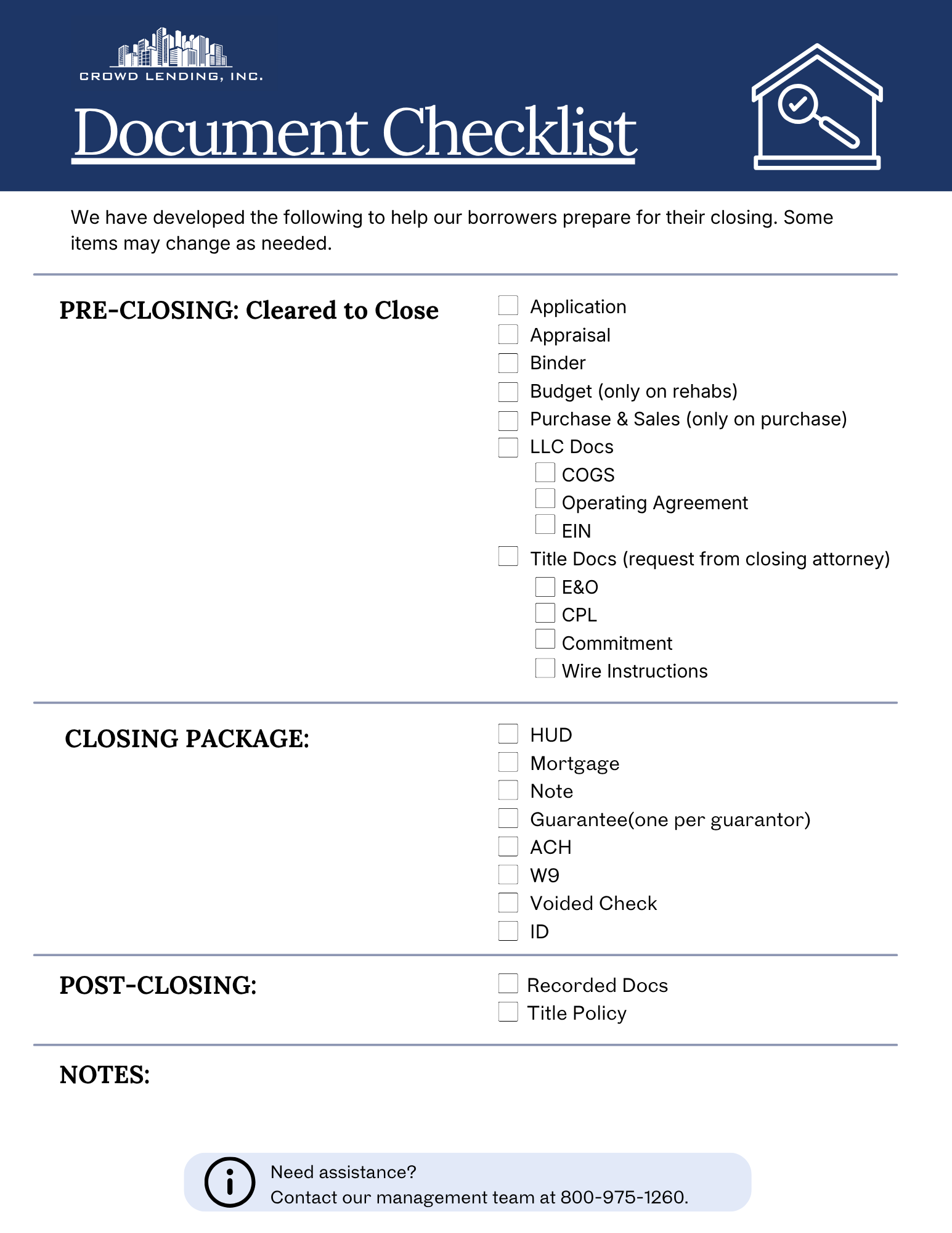

Application

Borrower submits an application, which includes basic information about the borrower and the transaction so we can start the approval process.

-

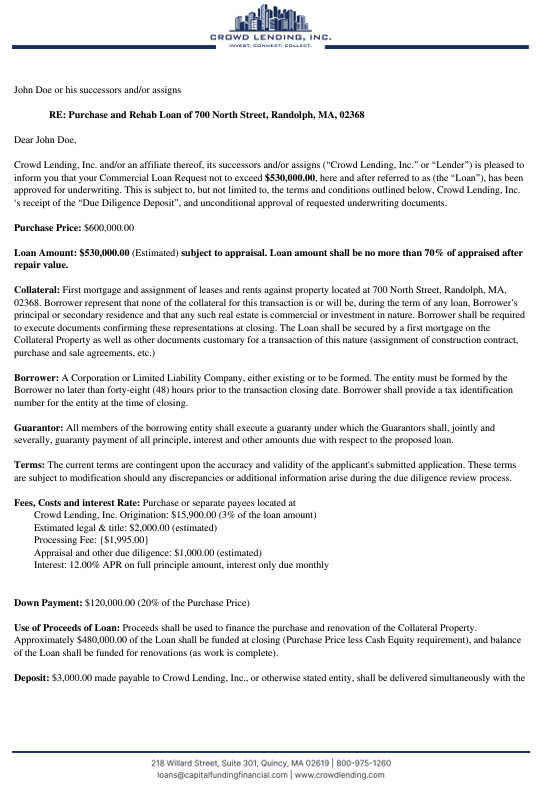

Term Sheet / Deposit

Crowd Lending, Inc. issues preliminary term sheet, and *Borrower submits deposit. The Preliminary Term Sheet includes the details of the terms of the loan to avoid financial reprisal.

*For most deals, the Crowd Lending, Inc. deposit is $3,000

-

Underwriting

Crowd Lending, Inc. vets the deal.

-

Closing

Crowd Lending, Inc. loan closed and funds are released. Crowd Lending team will work diligently to ensure a smooth transaction.

-

Post Servicing

Support beyond closing all managed in house with our expert team.

Loan Products-

Under $1 Million

Crowd Lending’s streamlined process is perfect for that quick first flip perfect OR that bridge loan scenario. We understand that every dollar counts and that time is money in these deals. Crowd Lending’s flexibility allows you to realize more profits.

-

$1 - 3 Million

As the loan size increases so does the risk. Crowd Lending is your partner on these mid-size deals to ensure that the closing, construction and exit strategy are executed seamlessly.

-

Over $3 Million

The larger the loan the more intricate the process. Crowd Lending’s experience in this space gives you a partner you can trust. One that is familiar with the financing, construction and exit of these larger projects. Together we won’t miss a thing. Insuring maximizing profits to the Sponsor.

-

[do not delete]

Frequently Asked questions-

We can close in as little as 2 weeks.

-

Our maximum Loan to Value ratio is 70%

-

Most of our loans are one year terms with an origination fee of 2%-4% and an interest only rate between 11-14%. Each deal is different.

Did you know?Crowd Lending works closely with Brokers to ensure that both their needs and the needs of their clients are met.

Are you ready to fund your project?

Filling out our Loan Inquiry form is the first step in our funding process.